Build Your Property Portfolio With Expert Insights And Future Data...

STOP CHASING YESTERDAY’S HOTSPOTS... BUY WITH FUTURE DATA

Learn How To Buy Property With Town Planning Data That Reveals Where The 12-15% Annual Growth Is

15+ Years Experience

$400M+ Value of Properties

750+ Successful Clients

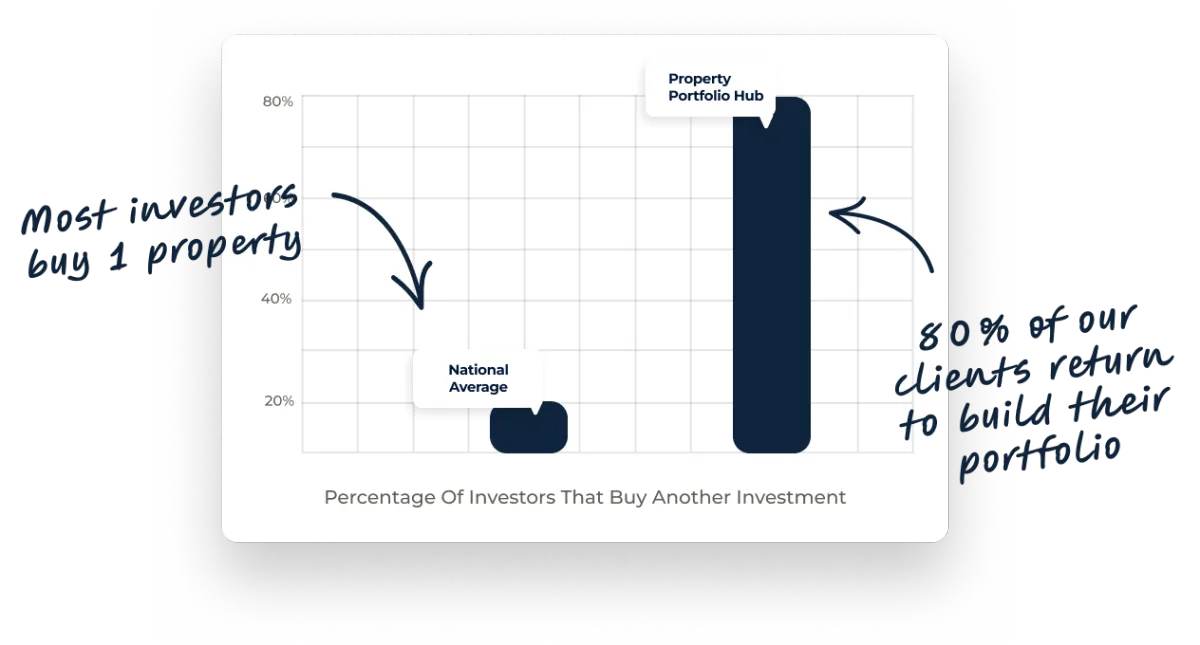

80% Client Return Rate

15+ Years Experience

$400M+ Value of Properties

750+ Successful Clients

80% Client Return Rate

Dated: 09/12/2025

“It's like X-ray vision into the future of property markets...”

And no... it's not some crazy tech.. artificial intelligence... or secret algorithms.

It's the boring town planning documents most buyer's agents and investors don’t know how to read.

Used by over 700+ investors who are getting annual growth between 12-15% whilst others struggle to break even.

Why?

Because 99.9% of investors make the same costly mistake...

They are stuck on locations that have already reached their peak,

They're buying investment properties based on what happened last year.

Last month.

Last week.

They're investing with yesterday's information in tomorrow's market.

They buy based on hope, not data.

It's crystal balling property portfolios.

But what if you could flip the script?

What if instead of buying based on the past 12 months of sales data...

You could buy with 15 years of data on the growth of a location?

Revolutionary, right?

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

My name is Nakul, I've spent 15 years living in real estate world.

As a certified land economist, I’ve analysed feasibility studies worth billions across iconic projects developed by leading community developers, governments and institutional investors.

My name is Nakul, I've spent 15 years living in real estate world.

As a certified land economist, I’ve analysed feasibility studies worth billions across iconic projects developed by leading community developers, governments and institutional investors.

I sat in CBRE boardrooms watching large-scale master planned community builders and township developers plan their land purchases 7-8 years in advance.

I worked directly with government planning departments.

I know how developers think.

I know where they're buying.

I know why they're buying.

And here's what I discovered...

Every property investment comes down to one simple equation: Supply vs. Demand.

We discover this through the blueprints of Australia's future.

Town planning documents that show where new infrastructure will drive demand...

Developer strategies that reveal where land banking is happening.

That’s how 700+ investors are gaining 12-15% annualized capital returns...

And you can too.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Check Out Some Of Our Recent Acquisitions Based on Supply Chain movements

Western Sydney,

NSW

$710,000: Purchase Price

$1,200,000: Updated Valuation

$490,000: Capital Growth

Hunter Valley, NSW

$655,900:Purchase Price

$1,100,000: Under Market Value

7.1%: Rental Yield

Northern

Adelaide, SA

$435,000: Purchase Price

$650,000: Updated Valuation

$215,000: Capital Growth

Geelong, VIC

$954,000: Purchase Price

$1,050,000: Updated Valuation

15.8%%: Rental Yield

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Check Out Some Of Our Recent Acquisitions Based on Supply Chain movements

Western Sydney, NSW

$710,000: Purchase Price

$1,200,000: Updated Valuation

$490,000: Capital Growth

Hunter Valley, NSW

$655,900:Purchase Price

$1,100,000: Under Market Value

7.1%: Rental Yield

Northern Adelaide, SA

$435,000: Purchase Price

$650,000: Updated Valuation

$215,000: Capital Growth

Geelong, VIC

$954,000: Purchase Price

$1,050,000: Updated Valuation

15.8%%: Rental Yield

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Investments With Property Portfolio Hub Compared To Traditional Investing

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Investments With Property Portfolio Hub Compared To Traditional Investing

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Hear From Families Who Built a high growth portfolio with us

5 Reasons Why Smart investors Choose Us to make data-backed investments

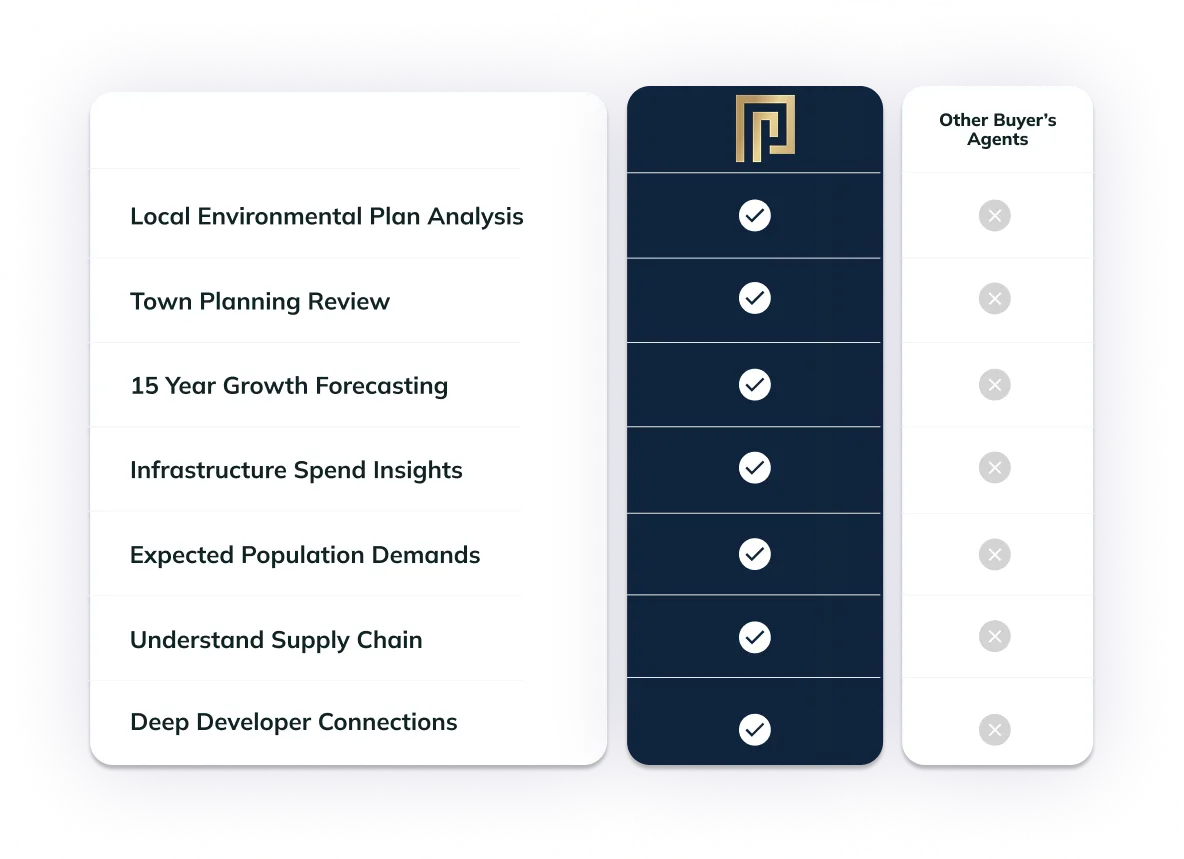

Comprehensive market analysis

Track infrastructure spend to invest ahead of market trends, urban growth, and development pipelines, so your property grows from day one.

Supply & Demand Identification

With on-the-ground developer access and insider market knowledge, we pinpoint future growth locations backed by infrastructure spend.

360° Real Estate Value Chain Insight

Get the full comprehensive overview with our guidance. We analyse the full property development cycle, from zoning approvals to land releases and infrastructure timelines.

Direct-from-Source Properties

Skip the inflated prices and agent markups, access exclusive, off-market investment deals direct from the source, often at below-market rates.

Long-Term Investment Strategy

Build genuine wealth with a tailored property portfolio designed through expert insights on town planning and infrastructure developments.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

5 Reasons Why Smart investors Choose Us to make data-backed investments

The Most Important Call You Must Do Before Your Next Property Investment

Give Me 20 Minutes And I'll Show You How To Buy Property With The Town Planning Data That Shows You Where Growth Will Be In The Next 5-10 Years

Buy Your Next Investment Property With The Town Planning Data That Shows You Where Growth Will Be In The Next 5-10 Years

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.

Give Me 20 Minutes And I'll give you access to the same infrastructure pipeline forecasts used by major developers.